The Board of Wema Bank Plc has announced the appointment of Yusuf Zubair Kazaure and Segun Opeke as Non-Executive Director and Executive Director respectively.

According to the bank in a notice to the Nigerian Exchange Limited (NGX) and the investing public seen by Nairametrics, the appointment of the addition of two new directors to its Board was effective from February 2, 2024.

The Bank who disclosed that it has received approval from the Central Bank of Nigeria to appoint the new directors noted that the duo are strong leaders in their relevant sectors and will bring a wealth of experience and expertise to the Board of the Bank.

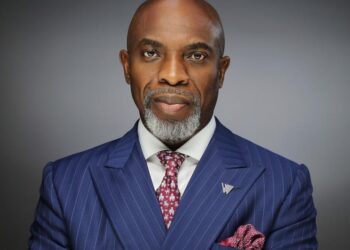

Profile of Mr. Yusuf Kazaure

According to the statement signed by Company Secretary/General Counsel, Johnson Lebile Mr. Kazaure is a seasoned professional with over thirty-five years of cumulative multi-sector working experience spanning Architecture, Construction, Banking, as well as Information and Communication Technology (ICT).

He is an experienced corporate and technology industry executive, focused on transformative outcomes and motivated by challenges.

Kazaure obtained a BSc and MSc in Architecture from the prestigious Ahmadu Bello University Zaria, Nigeria. He is also an alumnus of Bayero University Kano, Nigeria, and Oxford University, United Kingdom where he obtained an MBA and Diploma in Computing respectively.

He is currently pursuing a PhD in Cybersecurity at the Nasarawa State University, Keffi, Nigeria.

He started his career in public service in 1987 as an Architect in the Kano State Ministry of Works and Housing before moving into the banking sector where he worked for 10 years.

He served as the Permanent Secretary in the Ministry of Commerce and that of Urban & Regional Planning in Jigawa State and later became a Director General in charge of International and Governmental Affairs in the Executive Governor’s Office of Jigawa State between 1999 and 2002.

He was the pioneer Managing Director /CEO of Galaxy Information Technology and Telecommunication Ltd – the Jigawa State-owned ICT company in 2002, and later the CEO of Galaxy Backbone Ltd – a Federal Government owned ICT company in 2014 up until December 2019.

He was also the Chairman of the Board of Directors, of Nigeria Satellite Communications Ltd between January 2020 to June 2023 and a director of MAG Group Ltd, a multinational conglomerate with about eight subsidiaries/ affiliates that have a presence in over 20 countries.

Kazaure has attended several executive training courses at various universities and institutions across the world including Leading the Effective Sales Team at INSEAD, in France; Strategic Alliance at Wharton, University of Pennsylvania, USA; Securitization for Housing Finance, Fannie Mae, USA; the Advance Management Training Program (AMP) of the Lagos Business School; the CIO Institute of Carnegie Mellon University, USA to mention a few.

He is a fellow of the Nigeria Computer Society, a fellow of the Nigeria Institute of Management Consultants, and a fellow of the Nigerian Institute of Architects.

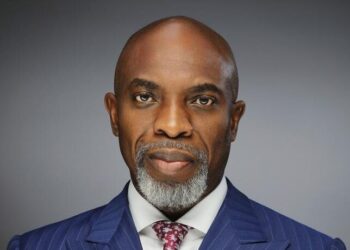

Profile of Mr. Segun Opeke

Mr. Segun Opeke is a result-oriented professional banker with over thirty-five years of working experience from leading Nigerian commercial banks.

He studied Banking and Finance at the University of Lagos and thereafter obtained an MBA from the same University of Lagos in 1999.

He is also an alumnus of the Columbia Business School, New York, and the London Business School, United Kingdom.

Segun started his career at Chartered Bank Limited and played diverse strategic roles in various banking institutions including leading the consumer banking team in FSB International Bank before proceeding to Prudent Bank as an Area Manager.

Following the consolidation of Skye Bank in 2006, Segun worked as the bank’s Treasurer and Regional Director and later became the Group Head of Corporate Banking, Aviation, and Maritime group.

Upon Polaris Bank taking over the defunct Skye Bank in 2018, Segun was made an Executive Director in charge of Lagos Business and Corporate Banking directorates until June 2023 when he retired from the Bank.

Segun has attended several professional, management, and leadership programs in world-class institutions including INSEAD and Euromoney, London.

He is a strong team player, and he is credited with making immense contributions in the areas of business development, corporate finance/restructuring, and digital transformation.

According to the Board, the addition of the two new directors will significantly enhance the wealth of knowledge within the Board of Directors of the Bank.

Banks and deception. Inviting northerner.to the board to be seen as a national bank. The same thing Fidelity Bank did. Dey play!

It’s important for banks to operate with transparency and integrity, regardless of their location or the background of their customers. While it may be beneficial for a bank to have a diverse board representing different regions and demographics, it’s crucial that their actions are driven by a commitment to fairness, equality, and ethical business practices.

If there are concerns about discrimination or unfair treatment in the banking industry, it’s essential for regulatory authorities to address these issues and ensure that all customers, regardless of their background, are treated fairly and have access to the same opportunities and services. Discrimination in loan collateral or any other aspect of banking services is not only unjust but also detrimental to the overall economy and financial stability.

Banks should strive to create an inclusive and equitable environment for all customers, and it’s important for them to be held accountable for their actions. Addressing these issues is crucial for the overall well-being and prosperity of the Nigerian banking system and the nation as a whole.