FCMB Pensions recently published its 2023 corporate and pension fund audited accounts, providing a summary overview of its financial health and fund performance.

This report provides a summary review and presents key financial highlights, financial ratios, fund performance, and the trend in the number of Retirement Savings Account (RSA) holders.

Financial Highlights

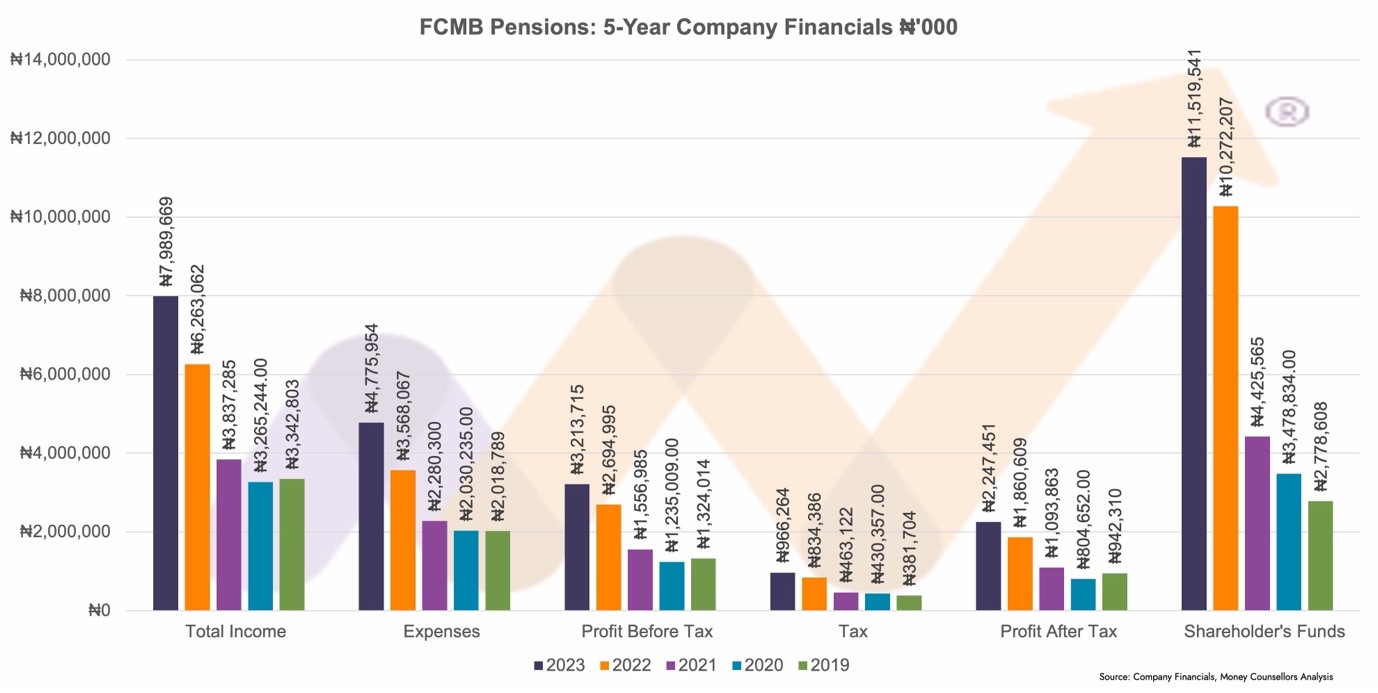

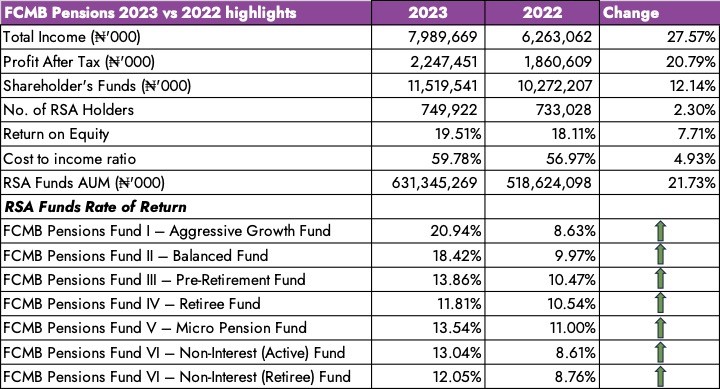

- Total Revenue: The audited accounts revealed a 28% increase in total revenue, growing to N7.99 billion in 2023, up from N6.26 billion in 2022. The rise in income came majorly from the fee income from managing pensions, which rose 25% from N5.81 billion to N7.27 billion.

- Profit After Tax (PAT): PAT rose 21% to N2.25 billion, slowing down considerably from the 70% growth of 2022 and the 36% of 2021.

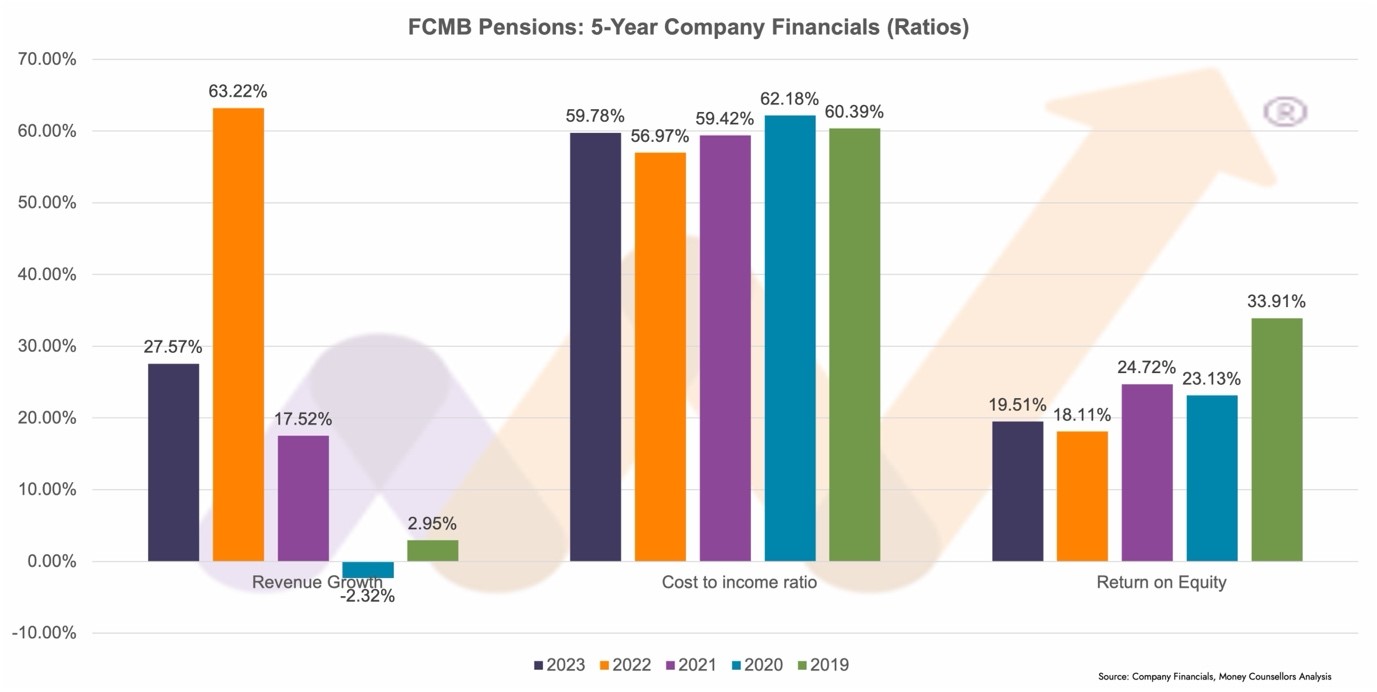

- Operating Expenses: Operating expenses rose faster than revenue and PAT, up by 34% to N4.78 billion from N3.57 billion, leading to a commensurate rise in the company’s cost-to-income ratio to 59.78% from 56.97% indicating the company feeling the inflationary pressures in the country.

- Shareholder’s Funds: The Company’s shareholders fund ended the year at N11.52 billion in 2023 up 12% from N10.27 billion in 2022.

- Return on Equity (ROE): ROE came in at 19.51%, below inflation which closed 2023 at 28.92%.

Financial and Fund Highlights

Corporate Audited Annual Results

Financial Ratios

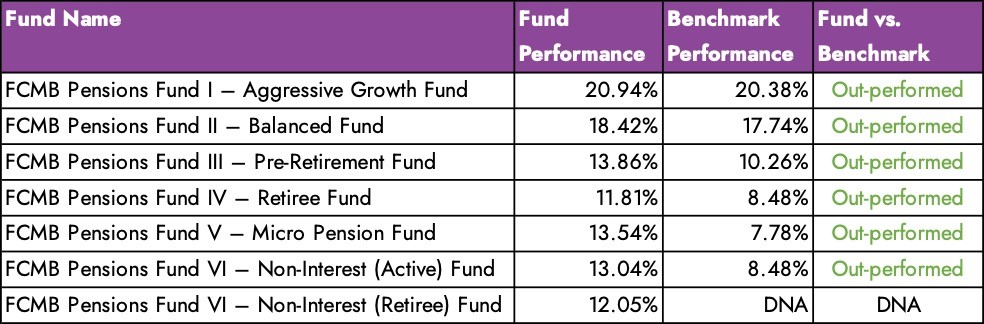

Fund Performance Highlights

- RSA Funds Performance: FCMB Pensions offers all 7 of the regulated RSA funds to the public. All 7 funds performed better in 2023 than they did in 2022 (see table above) and equally also outperformed their respective 2023 industry benchmark (see our article on benchmark returns here). None of the funds outperformed inflation, which closed December 2023 at 28.92%.

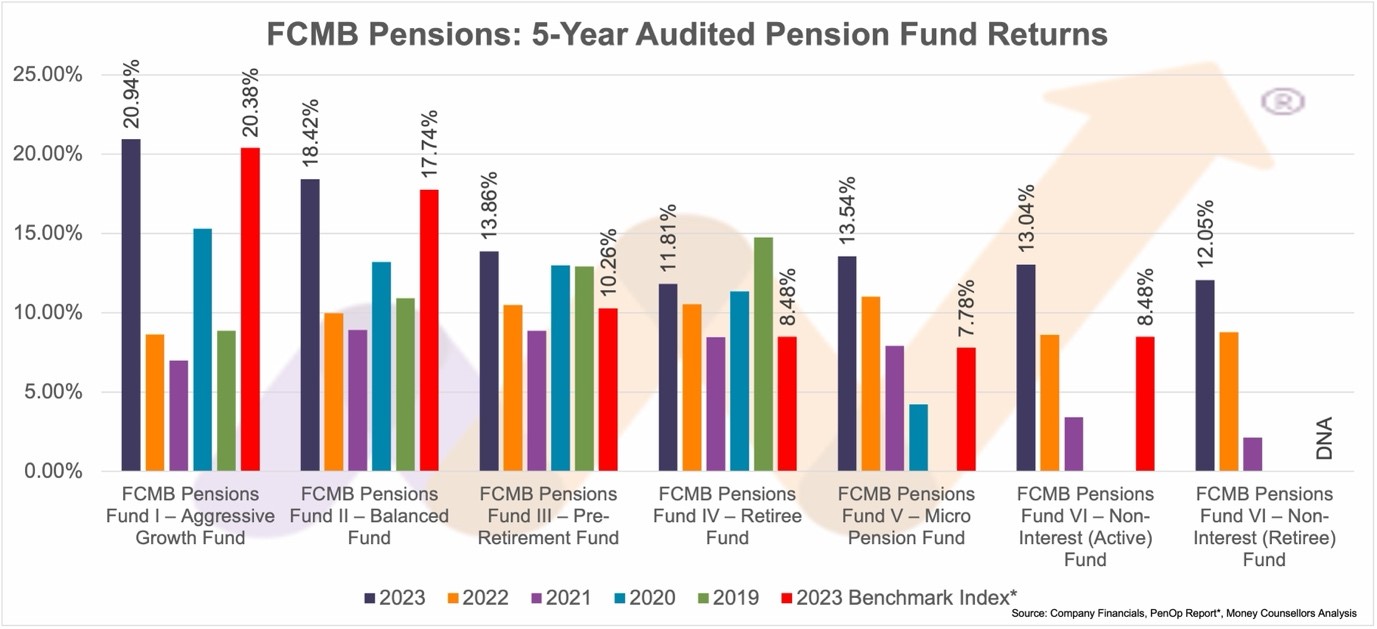

5-Year Audited Pension Funds Performance

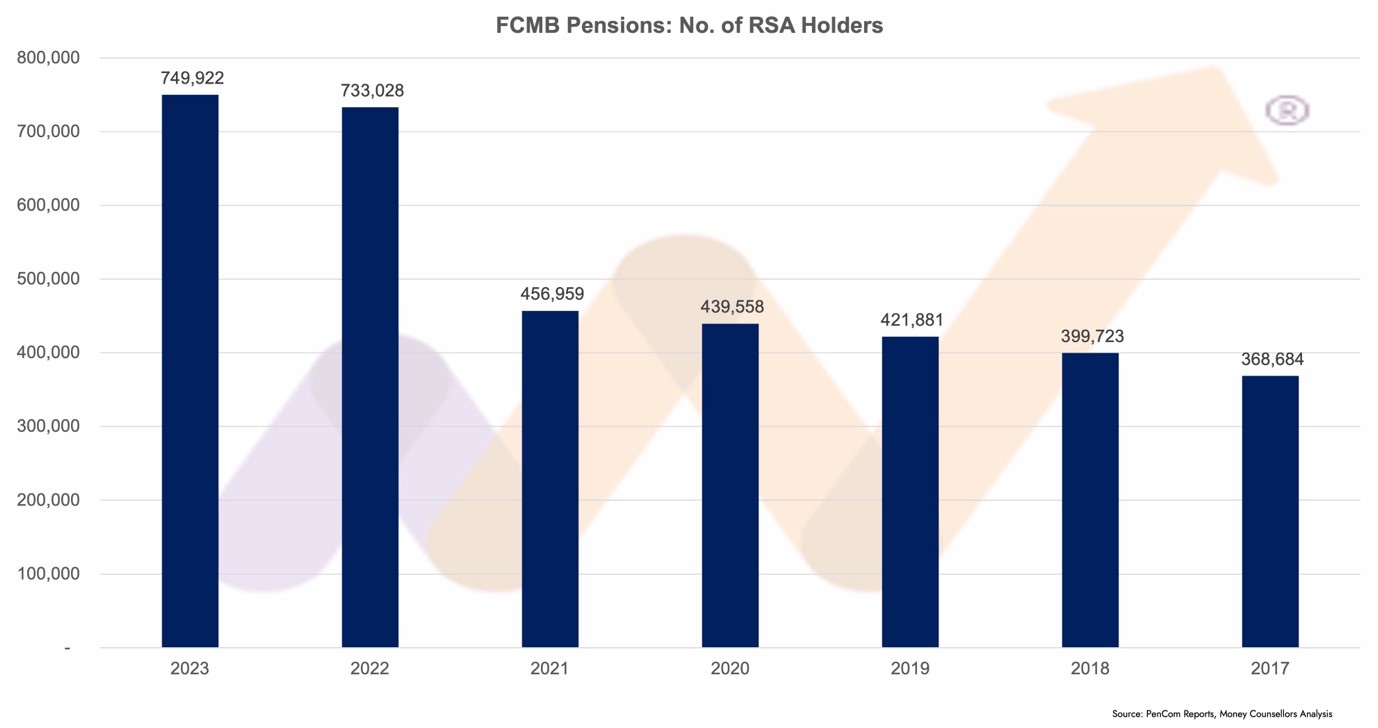

Number of RSA Holders

- RSA Growth: The number of RSA holders grew by 2.3% in 2023, reaching a total of 749,922, up by 16,894 from 2022.

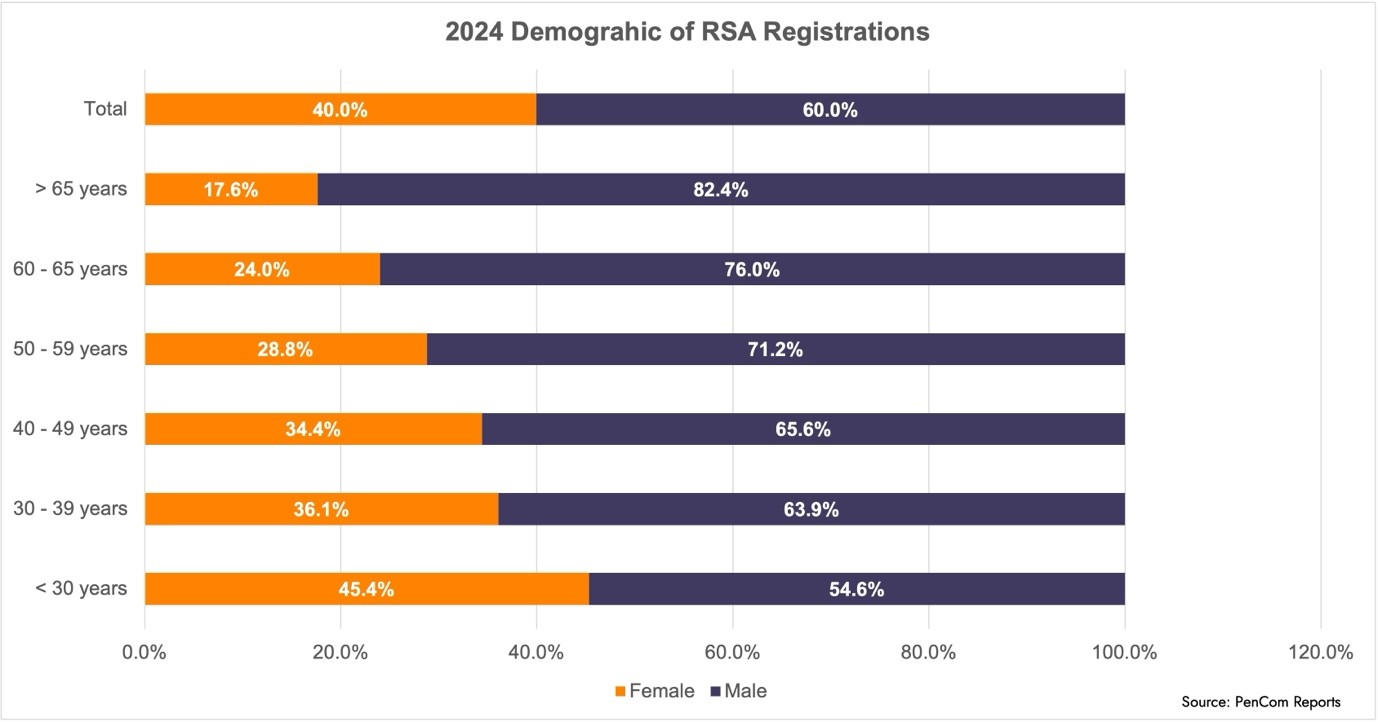

Demographic Analysis

- Age Distribution: The majority of 330,000 RSA holders (83.9%) registered in 2023 fell within the age bracket of <30 years to 39 years, indicating a young and growing industry subscriber base. Of the 2023 registrations, FCMB Pensions recorded 5.12% of this growth.

Conclusion

FCMB Pensions continues to demonstrate growth and stable financial health for its shareholders in 2023. Though slowed in 2023, revenue growth has remained in double digits and it has a reasonable cost-to-income ratio. Though all 7 pension funds did better in 2023 than 2022 and outperformed their benchmark indices, improvements in returns can be made, and the company’s investment managers should aim for that, which will be welcome from current RSA holders as well as anyone looking to use the transfer window to move to FCMB Pensions.

Watch out for the 2024 Money Counsellors Annual Report on Pensions. MCARP 2023 is available here.

© MoneyCounsellors.com