In general, the overall trend and sentiment of the market are judged based on major indices. It is quite common to witness headlines like “American markets at an all-time high,” or “Asian markets on a surge.” This does not mean that the prices of every stock in the market are increasing or at an all-time high. Such headlines are constructed based on the major stock market index of the country or continent.

What is a Market Index?

A market index is a statistical measure that displays the overall performance of its portfolio. A stock market index is used to gauge the average price movement for all the stocks that are included in the index. The selection and weighting criteria of the stocks can differ for each index.

An index can be of 4 types based on selection criteria of the stocks:

- Benchmark Index: Representing the performance of the stock market as a whole. It includes a large number of stocks from all sectors of the economy. In Nigeria, the NGX All Share Index is an example of the Benchmark Index.

- Broader Indices: These indices represent a major segment of the market but not the stock market as a whole. The basis of stock selection can be different for each index but stocks from all sectors are included in the broader market index. S&P 100 and NGX 30 are the broader market indices.

- Market Capitalisation Based Indices: All the stocks included in these indices have similar market value as these indices are based on market capitalization. For example, Russel Midcap Index.

- Sector Specific Indices: These are the stock market indices that include stocks from similar sectors or industries. The market capitalization of the stocks in the sectoral index can differ substantially. NGX Banking, NGX Oil and Gas, and NGX Consumer Goods are examples of sector-specific indices.

The methodology of construction and weightage of the stocks in indices can be different for each index. The stock market indices are mainly used for performance comparison with individual stocks or portfolios but can also be used for passive index investing.

The following are the most popular stock market indices across the globe.

- Africa – NGX All-Share Index, NGX 30, NGX 50, FTSE/JSE Top 40, FTSE NSE Kenya 15, FTSE NSE Kenya 25, EGX 30 Index, etc.

- USA – S&P 500, Dow Jones Industrial Average, Nasdaq Composite, S&P 100, Russel 1000, Russel 3000, Russel Midcap, CBOE NASDAQ 100, etc.

- Europe – FTSE 100, FTSE All-Share Index, CAC 40, DAX 30, FTSE MIB, IBEX 35, RTS Index, etc.

- Asia – Hang Seng Index, Nikkei 225, NIFTY 50, SSE 50, S&P SENSEX, PSE Index, etc.

- Australia – S&P ASX 20, S&P ASX 50, S&P NZX 50, etc.

Why do we need Indices and what do they tell you?

1. Reflects Investor Sentiment

Indices display the overall sentiments of the investors as a whole. If there is an increase in the demand for stocks, the prices will move upwards and the value of indices will also increase. Positive movement in prices of indices indicates positive sentiment among investors towards the market. However, indices only display the sentiment for a majority of investors but not every investor. Indices have a predefined number of stocks and their price moves according to the majority of stocks in their hypothetical portfolio.

2. Identifying Sectoral Trends and Benchmarking

The stocks included in an index are of similar types. The uptrend and downtrend in any of the sectors or categories of stocks can be easily benchmarked through their index. For example, if the prices of tech stocks or metal stocks are increasing, the index of tech and metal stocks will increase.

Indices act as a representative of their concerned segment of the market. There can be different trends for different types of stocks at times. These trends can be easily identified by analyzing the changes in the value of their concerned indices. Each stock market index acts as a benchmark for the respective set of stocks included in the index.

3. The Parameter for Peer Comparison

Each stock or portfolio of stocks can be compared with their respective index to identify the better performers in the market. Comparison of one index with another displays which segment of the stock market is on the rise and by what percentage compared to the major indices. Comparison of indices can also be done on a broader scale among different countries and continents to identify which nations or continents are having a positive and negative market trend.

Price trends in stock market indices can also be compared with their historic movements to identify the extent of price swings in the market. Historic price movements of indices can also assist in identifying possible upcoming trends by technical analysis.

4. Aids in Stock-Picking

Indices are an important benchmark for comparing the performance of stocks and portfolios over time. Better performers of every sector or market cap can be easily identified from an index. This can greatly enhance the stock-picking ability of the investor.

An index can assist in making the decision to buy, sell, or shift the allocation of money from one stock or sector to other. It reduces the effort for analyzing and timing the market which can eventually supplement the ability to identify better stocks at any moment.

5. Helps in Passive Investment

A stock market index can also act as an investment tool but it cannot be directly bought or sold. However, they can be traded in the derivatives market through options and futures contracts. Pooled investment tools like index mutual funds and ETFs allow interested individuals to invest in any particular index. The portfolio of ETFs and index mutual funds contains all the stocks that are underlying in an index.

With passive investment in stock market indices, investors do not need to spend time and effort in research and analysis of the market. A periodic investment in such instruments has historically provided lucrative returns at low risk.

6. Help Minimize Your Exposure to Risk

Analyzing the stock market index can also reduce the exposure to risk as they display the average price movement for a set of stocks. If an index shows volatile price movements, the underlying stocks also tend to be volatile. Such stocks can be avoided by low-risk investors but can be chosen by those with a high-risk appetite.

From a broader perspective, investors can also identify the volatility in stock markets of different countries. The volatility in the market at different times can be measured with indices to make a suitable investment decision in the stock market.

How are Stock Market Indices developed? Market Index Methodologies

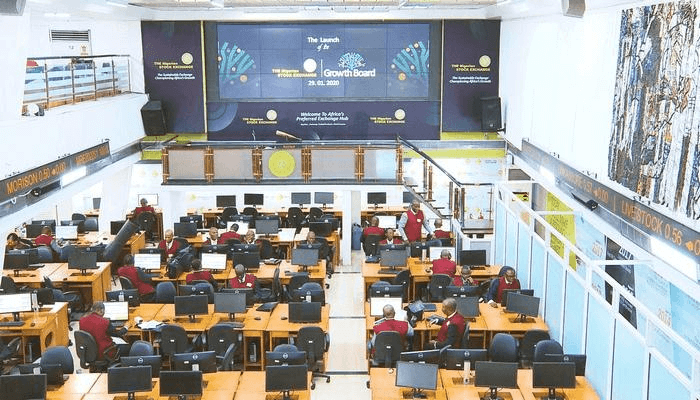

Each stock market index can have its own method to decide its value. This methodology is developed and maintained by the index provider. Index providers can be stocks exchanges like the Nigerian Exchange Group (NGX) or independent entities like Standard and Poor (S&P), FTSE Russell etc. The index providers maintain and regulate the stock market index developed by them.

The concentration of individual stocks in an index is weighted either by market cap or price. The valuation of indices can differ depending on the average weighing strategy followed by the index.

Market-Cap Weightage

Indices that are based on market-cap weightage include the proportion of stocks based on their market capitalization. Stocks of companies with higher market cap have a major impact on the index compared to those with lower market cap. Companies with lower market cap tend to be more volatile than their larger counterparts. The impact of such volatile stock on the overall valuation of such index gets averaged out by the stocks of large-cap companies with stable price movements.

The significant influence of major stocks can give a distorted view of market trends. This is a limitation for the market-cap weighted index but since the number of stockholders of major stocks is higher, many broad market indices are weighted on the basis of market cap.

Price Weightage

In a price-weighted index, the stock with the highest price will have a major impact on the valuation of the index. The methodology of such an index is simply the addition of prices for all the underlying stocks divided by the number of stocks. In these indices, a price movement of stock A from $500 to $510 will have the same impact as stock B that moved from $50 to $60. The valuation of the price-weighted index will be the average of all the stocks included in the index.

Apart from market-cap and price weightage methodology, the indices can also be constructed based on value-weightage and unweighted methodology.

How can you trade Indices in Nigeria?

For individuals residing in Nigeria, indices can be currently traded or invested through two methods.

Index Funds

Index mutual funds and ETFs are offered by the Nigerian Exchange (NGX) and the fund managers licensed with the Securities and Exchange Commission of Nigeria. These are the pooled investment tools in which the corpus is allocated in the underlying stocks of the index. The units of mutual funds or ETFs are bought, sold, and accumulated to gain profits. The prices of the units are the same as the value of the concerned index and change accordingly.

You can trade Nigerian Index ETFs based on NGX Banking/Pension/Industrial/Consumer Goods, NGX 30, Growth, Value Indices at NGX through a licensed broker or dealing member. Or you can invest in Index Mutual funds with SEC licensed fund managers. Investment in mutual funds through licensed fund managers incurs a fee that differs for each fund. Investment in ETFs costs slightly lower fees compared to mutual funds.

Some examples of Index ETFs include STANBIC IBTC ETF 30 which tracks NGX 30 index, VETIVA BANKING ETF based on NGX Banking index etc.

Index CFDs

Indices from all over the world like NASDAQ 100, CAC 40, DAX 30 can be traded through CFD brokers available in Nigeria. Trading CFDs does not involve any buying or selling of assets but only the values of Indices are speculated to book profits. CFDs are complex instruments with advanced trading strategy suited for experienced traders and are ideal for short-term trading like speculation on price movements. CFDs are not yet regulated in Nigeria but a few CFD & forex brokers are available in Nigeria that are regulated by foreign top-tier regulatory authorities in Europe.

CFD brokers also offer leverage in trading which allows opening bigger positions with small initial deposits. The fees can be incurred in form of spreads and commissions for each trade. CFD trading involves higher risk and is ideal for experienced traders and investors.

Saurav Sharma is a finance writer from South Africa who is experienced in stocks and forex. His research and publications mainly cover analysis and news related to financial markets in emerging countries.

Thank you so much for the light you shed

What a nice content.