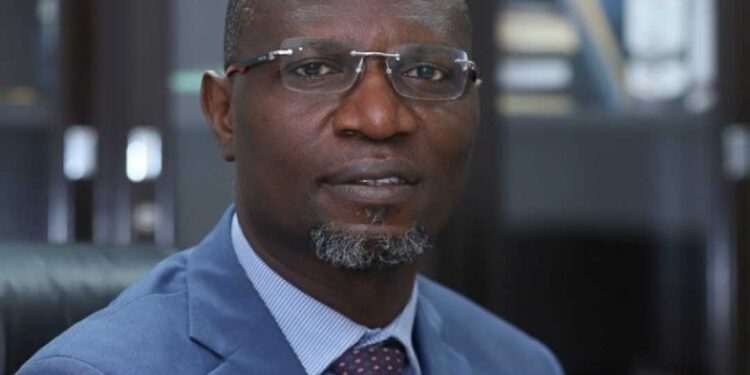

Shareholders under the aegis of the New Dimension Shareholders Association of Nigeria have called on the new Acting Director-General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, to find a lasting solution to the rising wave of unclaimed dividends in the country.

President of the New Dimension Shareholders Association, Mr. Patrick Ajudua, speaking to Nairametrics exclusively, said unclaimed dividends have defiled all logic and have kept on rising to over N190 billion despite the recently established Unclaimed Dividend Trust Fund.

The total value of unclaimed dividends according to SEC has risen to N190 billion, representing a 7.35% rise from N177 billion recorded in 2021, which was the last figure from the commission.

Recommended reading: Dangote Cement’s unclaimed dividend grows to N4.7 billion

According to Ajudua, shareholders are happy at the appointment of a capital market technocrat as DG of the SEC, adding that it is the expectations of investors that he builds on the various reform initiatives of the capital market that his predecessors started.

“Among issues deserving his attention is the unclaimed dividend which has defiled all logic and has kept on rising to over N190 billion despite the recently established Unclaimed Dividend Trust Fund.

He needs to revisit this as well as work with all stakeholders to ensure full implementation of the e-dividend mandate,” he said.

Other issues to follow up on, according to him, are investors’ education, the passage of the Investments and Securities Bill 2024, the implementation of the Revised Capital Market Master Plan (RCMMP) which is still ongoing, Identity Management, the establishment of a regulatory framework for the digital asset space, and commodities trading ecosystem.

Ajudua noted that for effective regulation of the market, the new board and management at SEC are expected to utilize various modern-day regulatory techniques/supervisory tools, monitoring/inspection, investigation, and strict enforcement of market rules while punishing any infraction.

Reasons for the rising wave of unclaimed dividends:

Market regulators and quoted companies have continued to urge investors in the capital market to register for e-dividends so that they can receive the benefits of their investments in the capital market. However, the growth of outstanding unclaimed dividends has continued to rise.

Reasons responsible for the growth of unclaimed dividends include issues of shareholders, who have died and without information on next of kin, multiple applications by applicants during the investment process, and deliberate actions to deny investors their benefits through various schemes by some registrars and companies who lack the liquidity to pay.

The Managing Director, of Crane Securities Limited, Mr. Mike Eze, while speaking to Nairametrics, traced the genesis of the rising wave of unclaimed dividends to the indigenisation era of the administration of General Yakubu Gowon.

According to him, “During this exercise, those in the position of authority who had the wherewithal acquired shares in the privatised companies with fictitious names of their drivers, cooks, gardeners, dead brothers, dead fathers, etc in such a way that when the dividends came, they were not able to claim them why because there are no such persons to claim such.”

Speaking in the same vein, Managing Director, of Highcap Securities Limited, Mr. David Adnori, explained that unclaimed dividends are increasing every year due to several factors. According to him, the problem started several years ago during the indigenisation exercises when several shareholders made multiple subscriptions in fictitious names whose signatures they cannot remember.

He noted that the affected shareholders were also unable to open bank accounts in these fictitious names for the e-dividend collection.

He added that most of the unclaimed dividends are statute-barred and forfeited to the companies and recovery by the affected shareholders may not be possible in the absence of means of identification.

Recommended reading: Practical steps to tackling perennial problem of unclaimed dividends in Nigeria

What you should know

- Over the years, the SEC has endeavored to curb the escalating issue of unclaimed dividends, albeit with limited success as the amount continues to rise annually.

- Two notable and commendable initiatives in this regard include the establishment of a search portal on the SEC website, enabling the public to verify if they possess any unclaimed dividends and the introduction of the Electronic Mandate Management System Platform by the Nigerian Inter-Bank Settlement System in collaboration with SEC and banks a few years ago.

- In February 2024, a self-service portal was launched on the platform, facilitating shareholders in processing applications for unclaimed dividends. Nevertheless, substantial efforts are still required to effectively tackle the challenge of unclaimed dividends in Nigeria.