Equinor has sold its Nigerian oil business to Chappal Energies. This is according to a statement released by the company on Wednesday, November 29.

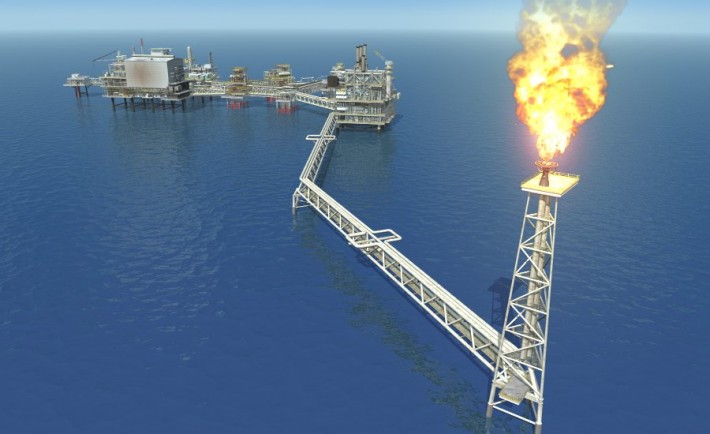

In the statement, it was said that the company has agreed to sell Equinor Nigeria Energy Company (ENEC), which owns about 54% of an oil and gas lease called OML 128.

This lease also includes a share in the Agbami oil field, which Chevron operates.

Equinor has been working in Nigeria since 1992 and has been a big part of developing the Agbami field, which happens to be Nigeria’s largest deep-water oil field.

Since it started producing oil in 2008, the Agbami field has generated over 1 billion barrels of oil, making profits for the partners involved and benefiting Nigeria.

The closing of the deal, however, is dependent on meeting certain requirements, including getting approvals from regulators and meeting contract terms.

Nina Koch, Equinor’s senior vice president for Africa Operations, mentioned that Nigeria has been crucial for Equinor for the past 30 years.

She explained that this deal with Chappal Energies helps Equinor focus on its key areas by optimizing its international oil and gas portfolio.

Chappal Energies, the company taking over, is a Nigerian-owned energy company committed to further developing these assets. They aim to continue contributing to Nigeria’s economy for years ahead. Ufoma Immanuel, Managing Director of Chappal Energies, said:

- “We are excited to take over the baton from Equinor after three decades of enduring legacy. Value creation, environmental stewardship, and community engagement are at the heart of everything we do, and our social and development impact will be the most important measurement of our success.

- “We are confident in our ability to make a lasting impact and are committed to fostering sustainable growth and contributing to Nigeria’s economic prosperity now and in the future.”

More Insights

In January 2023, Equinor indicated an interest in selling off its stake in the Nigerian offshore Agbami oilfield. At the time, Equinor said it had invested over $3.5 billion in its 20.21% stake in the Agbami oil field.

Meanwhile, Chevron is the operator with 67.30% interest and Prime 127 holds the remaining 12.49%. Equinor has drilled 10 wells with a 40% discovery rate.

Equinor launched its asset sale process after signing a deal in 2022 with the Nigerian National Petroleum Company (NNPC) Limited, to extend by two decades the license for offshore block OML 128, which is part of the Agbami field.

Sources revealed that production in the field has been declining rapidly in recent years, down from 36,000 barrels of oil equivalent per day (boepd) in 2019 and 29,000 boepd in 2020. Also, Equinor’s exit is part of the company’s efforts to focus on newer and more profitable assets.