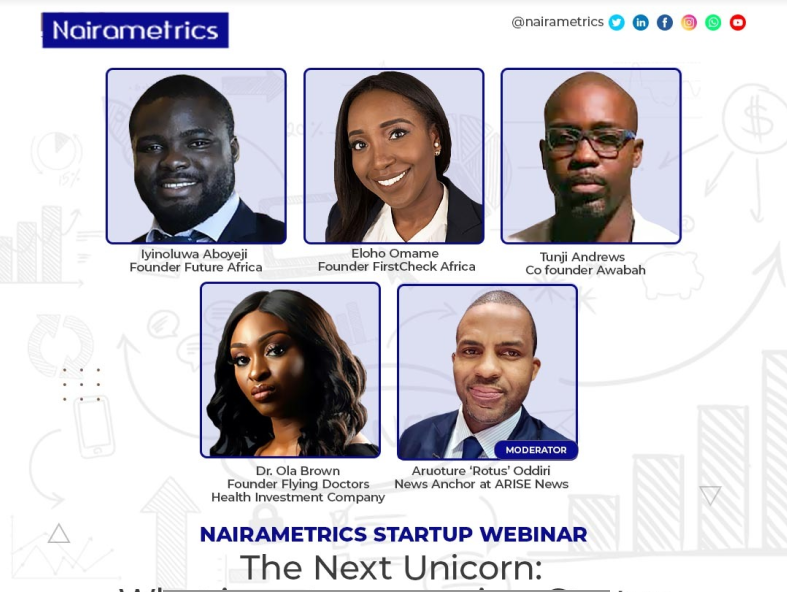

Over the weekend, Nairametrics hosted a startup webinar tagged, “The next unicorn: What investors want in a startup. The webinar was anchored by Aruoture “Rotus” Oddiri, News Anchor on Arise News.

The speakers at the webinar were, Eloho Omame, Founder, FirstCheck Africa; Iyinoluwa Aboyeji, Founder, Future Africa; Dr Ola Brown, Founder of Flying Doctors Health Investment Company; and Tunji Andrews, co-founder, Awabah.

Speaking on why businesses should raise funding, Dr Ola Brown said, “The primary reason why people raise funding is because they believe that the infusion of capital can accelerate and allow for exponential growth”.

Iyin Aboyeji said if you are a founder solving a hard problem in a large market, you should be asking for venture capital because other sources of capital might not give you a second look.

Eloho Omame said Venture Capital is the logical type of capital for businesses looking to solve a complex problem in a large market. She noted that it is important to have the investor-founder fit, which basically means that once a venture firm has decided to make an investment, its ability to win over the founder rests on finding a founder-investor fit.

Speaking on models businesses should take to attract investors, Tunji Andrews noted that businesses should focus on investors investing in their sector.

He said, “your business should have the potential to be 10x to be able to get investors to give you funding. At the pre-seed level businesses need a lot of resilience because they will get a lot of “NOs” as regards funding.”

Andrews stated that there is no blueprint to pitch to investors, as he got rejected by 80 angel investors but with persistence, he achieved remarkable standing.

”If you ask any founder, they probably tell you they pitched to 100 Investors, but you have to keep going especially when the business is at the pre-seed level,” Andrews said.

Speaking on the importance of incubator and accelerator programmes, Aboyeji said as much as they have a great advantage to a founder, they are not a guarantee to success.

“I think they (accelerator programmes) are very helpful in getting you at rhythm with your product and also helping in putting you in front of investors.

“Just because you go to an accelerator programme doesn’t mean you would be a successful company. For the most part, think of an accelerator as just enabling you access.

“You can liken it to a school. Just because you went to a good school doesn’t mean you are going to be successful in life. If you don’t study and learn and do the hardwork to build a career, it doesn’t matter whether you went to Harvard, you could still fail,” Aboyeji said.