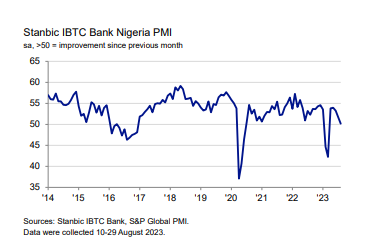

The latest Stanbic IBTC Purchasing Managers’ Index™ (PMI®) for Nigeria has shown a modest yet positive improvement in business conditions.

The PMI for September stood at 51.1, up from 50.2 in August, indicating a slight monthly upturn in the private sector.

This encouraging development comes despite the challenges faced by businesses in Nigeria.

Strong cost pressures, driven by exchange rate weakness and higher fuel costs, have continued to affect firms operating in the private sector.

These factors have contributed to a steep increase in input prices, with some of the sharpest rate rises on record.

Key highlights

The PMI is a crucial indicator of business conditions, with readings above 50.0 signaling an improvement compared to the previous month, while readings below 50.0 indicate a deterioration.

- September’s PMI reading suggests that Nigeria’s private sector is experiencing a moderate uptick in activity, albeit still hovering just above the no-change mark.

- New orders increased for the sixth consecutive month, reflecting an improvement in demand. However, this growth remains modest, primarily due to market conditions that have been characterized by weak consumer demand and price hikes that deter customers.

- Output levels returned to growth in September following a slight reduction in August. Yet, similar to new orders, the pace of increase remained modest, with manufacturing being the only sector showing a decline.

- One of the significant factors constraining demand in the private sector is the sharp rise in prices. Input costs surged, mainly due to exchange rate fluctuations and escalating fuel expenses. Companies also had to raise wages significantly to help their staff cope with higher transportation costs. This led to a notable increase in staff cost inflation.

Despite the rise in input costs, selling prices saw a steep rate of inflation. This was driven by the cumulative effects of increased purchase costs, despite being the weakest inflation rate since May.

Employment continued to grow slightly for the fifth consecutive month, indicating a cautious expansion. Purchasing activity also expanded, but the rate of growth slowed to a six-month low.

A similar trend was observed in the growth of stocks of purchases.

Suppliers’ delivery times were shortened due to competition among vendors, prompt payments, and favourable traffic conditions.

Looking ahead, confidence in the year-ahead outlook for output remained unchanged in September, but it remains one of the weakest on record. Companies that predicted an increase in activity primarily linked it to plans to hire additional staff to support business expansion.

Expert Opinion

Muyiwa Oni, Head of Equity Research West Africa at Stanbic IBTC Bank, shared his insights on the latest PMI figures:

- “Nigerian private sector business activity expanded slightly in September, a reversal from the contraction in August, reflecting a slight improvement in business activity but still showing price pressure strain on businesses. The headline PMI increased to 51.1 in September, from 50.2 in August, which was the lowest point over the past five months.”

Oni continued,

- “Prices remained elevated, with input and purchase prices remaining at period highs. Input prices increased materially across the major sectors covered, with inflationary pressures most pronounced in wholesale & retail and manufacturing. Majority of the respondents also signaled an increase in purchase prices linked mainly to exchange rate weakness and higher fuel costs. Staff costs were also increased at the second-fastest pace since the survey began in January 2014 because of high transportation costs for workers.

- “August inflation print continued to show increased cost pressure as CPI increased to 25.8% from 24.08% in July. Core inflation increased to 21.5% from 20.8% in July, while food inflation increased to 29.34% from 26.98% in July.”